accounts payable outsourcing providers

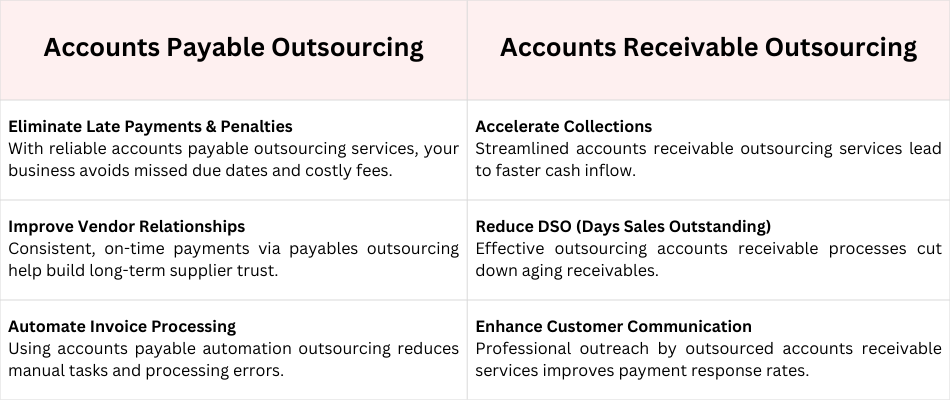

Key Features of Our AP & AR Outsourcing Services

At Accounting Ally Group, our outsourcing accounts payable process and outsourcing accounts receivable processes are designed to give you greater efficiency, accuracy, and peace of mind. Whether you’re looking to outsource accounts payable or outsource receivables, our services are built with the flexibility, security, and scalability your business needs.

We specialize in delivering comprehensive accounts payable and receivable outsourcing services that integrate seamlessly with your operations and support your financial goals.

Seamless Integration with ERP/Accounting Software

Our outsourced AP and accounts receivable outsource solutions are built to connect directly with your existing ERP or cloud-based accounting systems. We ensure a smooth data flow between your internal systems and our operations, reducing duplication, delays, and discrepancies. With our robust accounts payable outsourcing software and accounts receivable outsourcing automation, you’ll always have access to real-time financial data.

Customizable Workflows

Every business has unique needs — that’s why we offer fully customizable payables outsourcing and receivables outsourcing workflows. From invoice approvals and payment schedules to collections and reconciliation, we tailor our outsourcing accounts payable and receivable services to match your internal processes and industry requirements. Whether you’re managing high transaction volumes or complex approval chains, our team will design an efficient and scalable solution for you.

Dedicated Account Managers

When you outsource accounts receivable or accounts payable, you gain more than a service — you gain a partner. Each client is assigned a dedicated account manager to oversee their accounts payable and receivable outsourcing services. This single point of contact ensures consistent communication, timely support, and proactive issue resolution, keeping your operations smooth and stress-free.

Data Security and Compliance

We take data protection seriously. Our accounts payable outsourcing company and accounts receivable outsourcing firm operate with the highest standards in security and compliance. From encrypted file transfers to strict access controls, we ensure your sensitive financial data remains secure. We also adhere to relevant financial regulations and audit protocols, making outsourcing accounts receivable management and AP functions a safe, compliant choice.

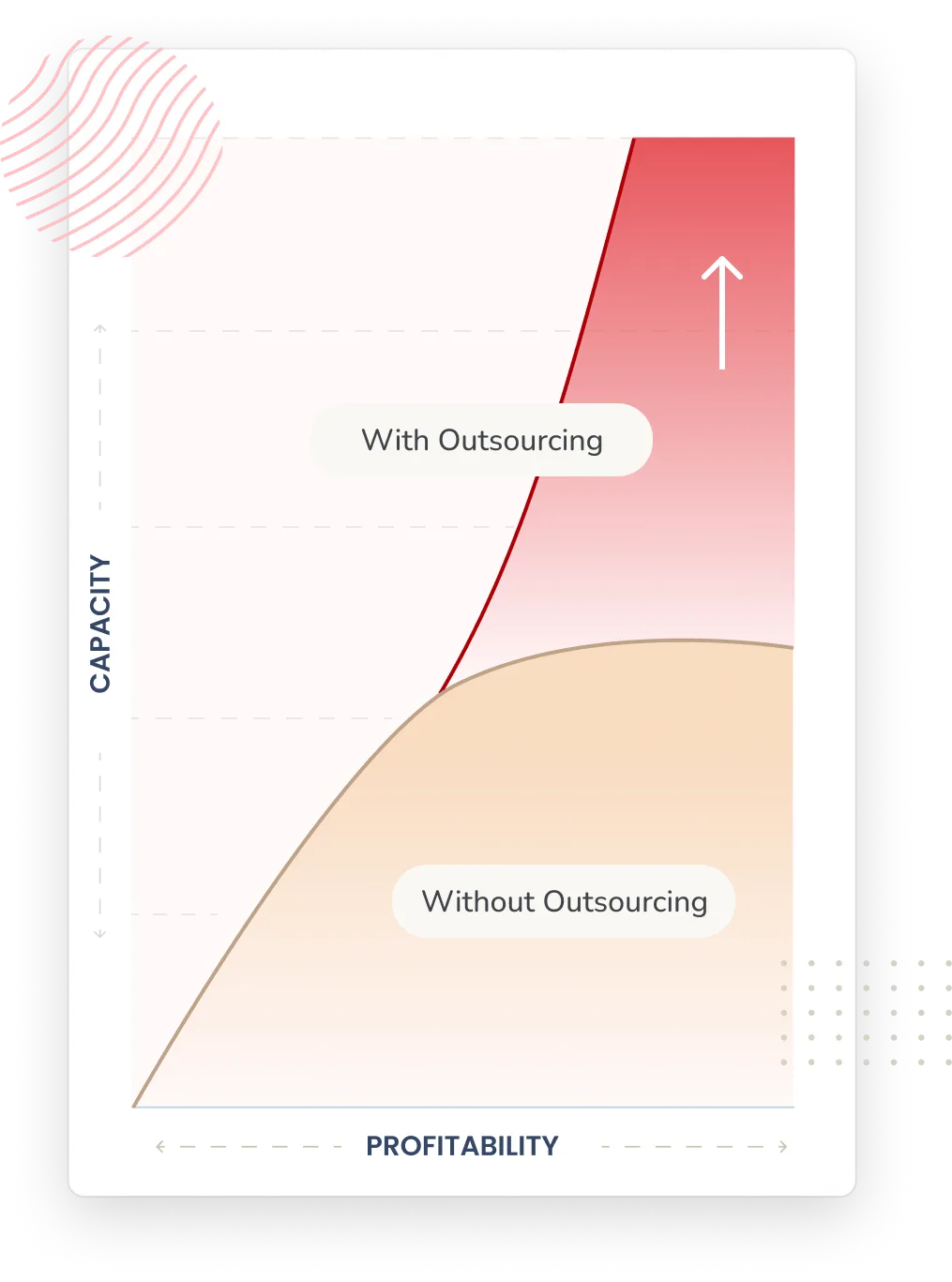

Scalable Payables Outsourcing for Growing Businesses

Whether you’re a startup, mid-sized company, or expanding enterprise, our payables outsourcing solutions are designed to scale with you. As transaction volumes increase, our accounts payable outsourcing providers deliver the automation, process control, and team capacity needed to grow without delays or bottlenecks. Our offshore accounts payable support ensures 24/7 coverage, faster turnaround, and cost savings at scale.

With our support, you can:

- Automate routine AP tasks

- Reduce manual errors and approval delays

- Improve vendor relationships with on-time payments

- Gain real-time visibility into liabilities and cash flow

We’re trusted by businesses seeking reliable accounts payable outsourcing companies that deliver measurable value.

Secure and Compliant Outsourced Accounts Receivable Services

Our outsourced accounts receivable services are built on trust, transparency, and performance. With best-in-class accounts receivable outsourcing automation, our team enhances your collection efforts, speeds up cash application, and ensures accurate reconciliation. We follow strict data governance and compliance standards, making us a top choice among accounts receivable outsourcing companies.

Key benefits include:

From accounts payable and receivable outsourcing services for small businesses to large-scale enterprise solutions, we provide dependable accounts receivable outsourcing management that drives financial success.

99% SLA Delivery

99% SLA Delivery 10,000+ Pin codes Network in India

10,000+ Pin codes Network in India