Finance and Accounting Outsourcing: How to Streamline Operations and Cut Costs?

Running a small business or startup comes with a wide range of responsibilities, and managing finances can often feel like one of the most complex and time-consuming tasks. From maintaining accurate records to ensuring compliance and preparing for audits, the demands on your accounting team can quickly become overwhelming. This is where outsourcing accounting services for small business becomes a strategic advantage. By leveraging external expertise, small companies can gain not just cost savings, but also enhanced accuracy, scalability, and operational efficiency.

In this blog, we will explore how finance and accounting outsourcing can transform your business. We’ll examine the various types of services available, how to select the right partner, and the benefits that come with outsourced accounting services, especially for growing startups and small enterprises. If you’re looking to streamline your operations, improve compliance, and cut costs without sacrificing quality, read on to discover how accounting outsourcing services can be your next smart business move.

Understanding Finance and Accounting Outsourcing

Finance and accounting outsourcing refers to the practice of hiring external service providers to handle various financial functions such as bookkeeping, payroll, tax preparation, financial reporting, and strategic financial planning. These services are delivered by professionals who specialize in finance and accounting, often with a deep understanding of industry-specific regulations and compliance requirements.

For small businesses, outsourcing accounting services can be a game changer. It allows them to focus on core business activities while ensuring that their financial records are accurate, compliant, and up-to-date.

Why Outsourcing Accounting Services for Small Business Makes Sense

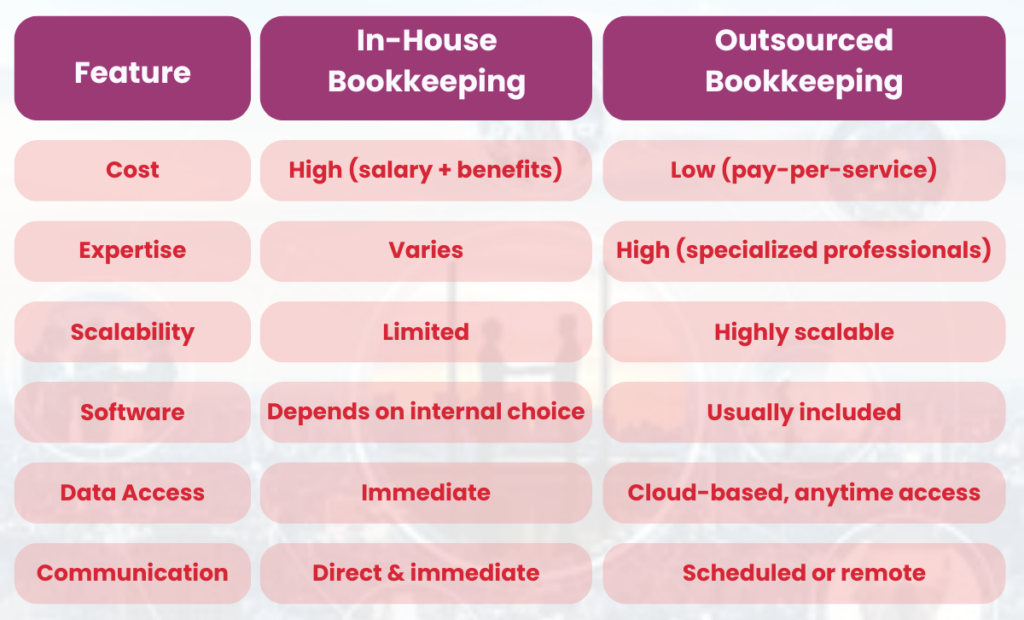

Small businesses face numerous challenges when managing their finances, from limited resources to a lack of in-house expertise. Here are several compelling reasons why outsourcing accounting services for small business is a smart move:

1. Cost Efficiency

Hiring and training a full-time, in-house finance team is costly. In contrast, accounting outsourcing offers a more affordable alternative. Businesses only pay for the services they use, avoiding overhead expenses such as salaries, benefits, office space, and equipment.

2. Access to Expertise

An outsourced accounting firm for startups or small businesses brings a team of experienced professionals with extensive knowledge of accounting principles, tax laws, and financial best practices. This level of expertise is often difficult to match internally.

3. Focus on Core Activities

Outsourcing frees up time and internal resources, allowing business owners and teams to concentrate on strategic growth, product development, and customer service.

4. Improved Accuracy and Compliance

Outsourced accounting services ensure accurate record-keeping and timely reporting. These providers stay current with the latest regulatory changes, helping businesses avoid penalties and ensure compliance with tax authorities and financial regulations.

5. Scalability and Flexibility

As a business grows, so do its accounting needs. Accounting outsourcing services can easily scale to meet the demands of a growing business, offering the flexibility to add or reduce services as needed.

Types of Accounting and Finance Functions That Can Be Outsourced

When it comes to outsourcing accounting and bookkeeping services, businesses can choose to outsource all or specific parts of their finance function. Here are some of the most commonly outsourced services:

- Bookkeeping: Recording daily financial transactions accurately.

- Accounts Payable and Receivable: Managing incoming and outgoing payments.

- Payroll Processing: Ensuring employees are paid accurately and on time.

- Tax Preparation and Filing: Handling corporate taxes, VAT, GST, and other tax obligations.

- Financial Reporting: Preparing monthly, quarterly, and annual reports.

- Budgeting and Forecasting: Assisting with financial planning and decision-making.

- Audit Preparation: Supporting businesses in audit readiness.

Benefits of Partnering with an Outsourced Accounting Firm for Startups

Startups, in particular, can benefit immensely from finance and accounting outsourcing. Operating on tight budgets and lean teams, startups need accurate financial information to make informed decisions. Here’s how outsourcing can make a difference:

1. Faster Time-to-Market

By delegating non-core functions like accounting, startups can focus on product development and customer acquisition.

2. Investor-Ready Financials

Professional accounting outsourcing services ensure that financial statements are prepared to a high standard, increasing investor confidence.

3. Risk Reduction

Outsourced accounting firms offer built-in checks and controls, reducing the risk of fraud or errors in financial reporting.

4. Strategic Insights

Many firms go beyond basic bookkeeping to offer strategic insights that help startups with funding, scaling, and profitability.

Choosing the Right Provider for Accounting Outsourcing

Finding the right outsourcing partner is crucial. Here are some key factors to consider:

1. Experience and Reputation

Look for a provider with a proven track record and experience in your industry. Positive reviews and client testimonials can offer valuable insights.

2. Range of Services

Choose a firm that offers comprehensive accounts outsourcing services tailored to your business needs.

3. Technology Integration

A good outsourcing partner should use modern accounting software and tools, ensuring seamless integration with your business systems.

4. Data Security

Ensure the provider has robust data protection policies and complies with relevant regulations, such as GDPR or CCPA.

5. Communication and Support

Effective communication is key. Your outsourcing firm should offer clear, timely updates and be accessible when you need assistance.

Real-World Impact: Case Studies of Successful Outsourcing

Case Study 1: Tech Startup Streamlines Growth

A technology startup experiencing rapid growth outsourced its accounting and bookkeeping services to a specialized firm. This move enabled the company to receive real-time financial reports and cash flow forecasts, which helped attract venture capital funding and improve internal budgeting processes.

Case Study 2: Small Retail Business Cuts Costs

A small retail business struggling with cash flow issues turned to an outsourced accounting firm. The firm implemented cost-saving strategies, automated invoicing processes, and provided regular financial insights, which helped the business reduce expenses by 30% within the first year.

Case Study 3: Global Expansion Made Easy

An e-commerce business planning international expansion used finance and accounting outsourcing to navigate the complexities of cross-border tax compliance and financial reporting. The outsourced team ensured smooth operations across multiple jurisdictions.

Key Considerations When Transitioning to Outsourced Accounting

Transitioning from in-house to outsourced accounting involves several important steps:

1. Assess Your Current Processes

Document your existing accounting practices and identify inefficiencies.

2. Set Clear Objectives

Define what you hope to achieve with outsourcing—whether it’s cost reduction, compliance, or operational efficiency.

3. Choose the Right Partner

Take your time to vet potential partners. Look for firms with strong references and deep domain expertise.

4. Onboard Thoughtfully

Plan for a smooth transition by involving all stakeholders and setting up a clear communication protocol.

5. Review and Optimize Regularly

Periodically evaluate the performance of your outsourcing provider to ensure they continue to meet your evolving needs.

Common Myths About Outsourcing Accounting Services

Despite the proven benefits of accounting outsourcing, several persistent myths continue to deter some business owners from making the switch. Let’s explore and debunk some of the most common misconceptions:

Myth 1: Outsourcing Is Only for Large Corporations

Reality: This is perhaps the most common myth. In fact, outsourcing accounting services for small business has become increasingly popular because it provides access to high-level expertise without the high costs associated with hiring an internal team. Many outsourced accounting firms tailor their services specifically for startups and small businesses.

Myth 2: You Lose Control of Your Finances

Reality: A good outsourcing relationship is built on transparency and communication. Reputable firms act as an extension of your business, giving you full access to your financial data in real time and keeping you in the loop on all important decisions. You maintain full control while benefiting from expert guidance.

Myth 3: Outsourcing Is Not Secure

Reality: Data security is a top priority for most outsourced accounting services providers. They use encrypted communication, secure servers, and follow industry best practices for data protection. Partnering with a certified provider ensures your financial information is handled securely.

Myth 4: It’s More Expensive in the Long Run

Reality: Contrary to this belief, accounting outsourcing services often reduce operational costs by eliminating the need for in-house staff, software, and training. You pay for what you need—no more, no less—making it a highly cost-effective solution.

Myth 5: The Transition Process Is Too Complicated

Reality: A professional outsourcing partner will guide you through the entire onboarding process, making the transition smooth and minimally disruptive. With the right support, your business can experience improvements in financial efficiency from day one.

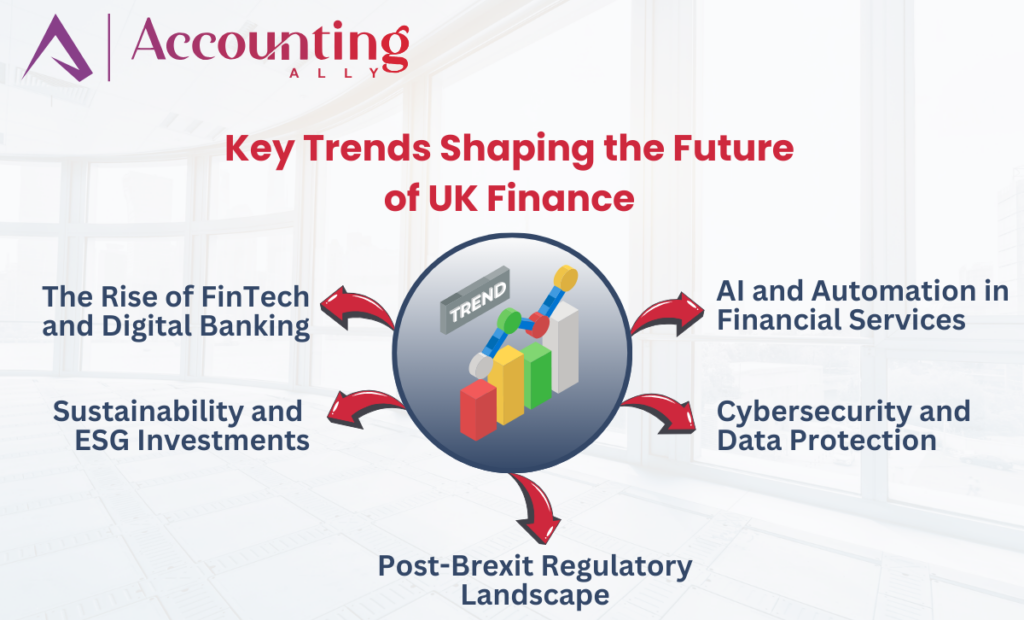

Future of Accounting Outsourcing

The future of accounting outsourcing is bright, especially as businesses embrace digital transformation. Cloud computing, AI, and automation are making outsourced services more efficient and insightful than ever. Here are some trends to watch:

- AI-Powered Analytics: Providers will increasingly offer predictive financial analytics to aid in decision-making.

- Blockchain Integration: Enhanced transparency and fraud prevention.

- Customized Dashboards: Real-time access to key financial metrics.

- Global Compliance Support: Helping businesses manage international financial obligations.

Conclusion

Outsourcing accounting services for small business is no longer just an operational tactic—it’s a strategic move. Whether you are a startup looking for agility or a growing company aiming to streamline processes, finance and accounting outsourcing can help you reduce costs, ensure compliance, and gain a competitive edge.

By partnering with a trusted provider of outsourced accounting services, businesses can leverage expert support and modern technology to simplify financial management and focus on growth. It’s time to embrace a smarter, more efficient way of handling your finances through reliable and scalable accounting outsourcing services.