Transform Your CPA Firm into a Lead Generation Powerhouse

Facing a nationwide shortage of accounting professionals, CPA firms across the United States and the United Kingdom are seeking innovative ways to maintain a competitive advantage.

One of the most effective strategies is leveraging outsourcing services for accountants to ensure efficiency and business growth.

Partnering with Accounting Ally for outsourcing for CPA firms has emerged as a strategic solution—not just to alleviate staffing challenges but also to significantly boost lead generation efforts.

The Growing Talent Gap & The Role of Outsourcing

The growing talent gap in the accounting industry has prompted firms to reassess how they manage workloads and distribute resources.

Once seen as a backup plan, outsourced accounting services have evolved into a core strategy for modern CPA firms.

By delegating routine tasks like bookkeeping, payroll, and tax preparation to Accounting Ally’s expert team, your firm can prioritize core business functions and client engagement.

This proactive approach not only resolves staffing constraints but also strengthens your firm’s image as a client-centric and forward-thinking organization.

Transforming Lead Generation through Outsourcing

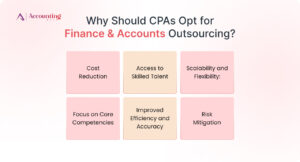

Additionally, outsourced bookkeeping companies for CPA firms can revolutionize your firm’s approach to lead generation. Expanding your service offerings and providing enhanced value solidify client relationships and encourage more referrals.

By improving operational efficiency and cutting costs, outsourcing makes your firm more appealing to prospective clients.

Choosing the Right Outsourcing Partner

Selecting the right outsourcing partner is critical. It requires a thorough understanding of your firm’s needs and a careful evaluation of potential providers.

Partnering with Accounting Ally, a firm aligned with your culture and quality standards, ensures seamless integration, consistently high service levels, and increased client satisfaction.

By embedding outsourcing services for accountants into your business strategy, you can build a stronger, more agile, and client-focused CPA firm.

This strategic move does more than address current challenges—it positions your firm for sustainable growth and superior client service.

Turn the Talent Shortage into a Competitive Advantage

As the demand for qualified accountants continues to outpace supply in 2024-25, your firm has an opportunity to stand out.

Outsourcing for CPA firms allows you to mitigate staffing shortages and redirect critical resources toward meaningful client interactions and complex advisory work.

This adaptability positions your firm as a proactive, client-first leader in a competitive market.

Expand Your Services Without Increasing Overhead

Imagine offering high-level CFO advisory services or tailored financial consulting without the need to hire additional full-time staff. With Accounting Ally’s outsourced bookkeeping companies for CPA firms, this becomes a scalable reality.

Effortlessly broaden your service portfolio to attract new clients and deepen relationships with existing ones—all without increasing your firm’s overhead. This strategy not only strengthens client retention but also generates new leads from clients seeking comprehensive financial solutions.

Boost Efficiency Firm-Wide

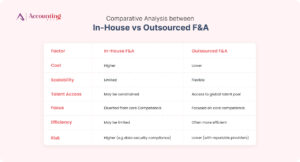

Operational efficiency isn’t just about reducing costs—it’s about improving service quality and responsiveness.

By outsourcing labor-intensive tasks like payroll processing and tax filings to Accounting Ally, your firm can focus on delivering faster, more precise services.

Increased efficiency leads to higher client satisfaction, fostering referrals and enhancing your reputation as a trusted advisor.

Select the Ideal Outsourcing Partner

The success of your outsourcing strategy depends on choosing the right partner. Accounting Ally brings industry expertise while aligning with your firm’s values and service commitments.

Our advanced technology, robust security protocols, and transparent communication practices ensure that we seamlessly integrate with your operations, functioning as an extension of your team.

Use Outsourcing to Drive Growth

Outsourcing is more than a response to staffing shortages—it’s a catalyst for growth. It empowers your firm to scale rapidly, handle more complex client demands, and explore new markets without the constraints of traditional hiring.

Partnering with Accounting Ally positions your firm to lead with innovation and deliver exceptional client service.

The Future of CPA Firms: Scaling with Outsourced Accounting

- How to Successfully Transition to Outsourced Accounting Services

- Key steps for CPA firms to seamlessly integrate outsourced services without disruption.

- Tips for ensuring data security and smooth workflow transitions.

- The Future of CPA Firms: Embracing Digital Transformation with Outsourcing

- How outsourcing providers like Accounting Ally leverage AI and automation to enhance efficiency.

- The role of cloud-based accounting solutions in outsourced services.

- Case Study: How CPA Firms Have Thrived with Outsourcing

- Real-life success stories of CPA firms that have scaled their business using outsourcing strategies.

- Insights into cost savings, improved client satisfaction, and revenue growth.

Outsourcing for Growth: Elevate Your CPA Firm with Accounting Ally

In the face of ongoing accountant shortages, outsourcing with Accounting Ally offers more than just workforce support—it’s a strategic growth driver.

This partnership expands your firm’s capabilities, allowing you to concentrate on core business areas and nurture client relationships. With the right outsourcing partner, staffing challenges become opportunities for innovation and advancement.

Outsourced accounting services not only fill resource gaps but also elevate your firm’s service quality. By delivering greater value and comprehensive solutions, your firm can strengthen client loyalty and attract new business, accelerating growth beyond the competition.

Streamlining operations and reducing overhead allows your firm to deliver consistent, high-quality results that exceed client expectations.

This strategic shift is about more than managing resources—it’s about redefining your firm’s potential.

With outsourcing services for accountants, your firm can swiftly adapt to evolving market demands and client needs without being restricted by traditional hiring processes.

Accounting Ally helps position your firm as agile, responsive, and forward-thinking—qualities that today’s clients prioritize and trust.

Frequently Asked Questions (FAQs)

- What are the benefits of outsourcing for CPA firms?

Outsourcing allows CPA firms to reduce overhead costs, improve efficiency, focus on core advisory services, and mitigate staffing shortages while maintaining high service quality. - How secure is outsourced accounting and bookkeeping?

Reputable outsourcing providers, such as Accounting Ally, implement stringent security measures, including encrypted data storage, secure cloud-based platforms, and compliance with industry regulations. - Will outsourcing bookkeeping services affect my firm’s client relationships?

No, outsourcing actually enhances client relationships by allowing firms to focus on strategic consulting and personalized services while routine tasks are handled by expert professionals. - How do I choose the right outsourcing partner for my CPA firm?

Selecting an outsourcing partner involves evaluating their industry experience, technology capabilities, security measures, and alignment with your firm’s values and service commitments. - Can I scale my firm’s services through outsourcing?

Yes! Outsourced bookkeeping companies for CPA firms help expand service offerings without increasing overhead costs, allowing firms to attract new clients and strengthen existing relationships effortlessly.