FAQ’s

Q1: What is the best way to find a CPA for hire?

Start by identifying whether you need local expertise or offshore support. Platforms like LinkedIn, CPA boards, and outsourcing firms offer access to pre-vetted professionals. For flexibility and cost efficiency, many CPA firms hire offshore CPA firms.

Q2: How to hire a CPA for a CPA firm in the USA or UK?

Define the role, determine the budget, and decide whether to hire in-house or offshore. Interview for both technical skills and regulatory knowledge (IRS, HMRC, GAAP, IFRS). Work with a reputable partner if going offshore.

Q3: What’s the difference between a certified management accountant vs CPA?

CPAs are ideal for public accounting and client-facing work, focusing on taxes, audit, and compliance. CMAs are more strategy- and management-oriented. For CPA firms, hiring a CPA is usually the best route.

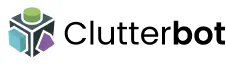

Q4: What’s the cost to hire a CPA locally vs offshore?

- Local CPA (UK): £60,000–£90,000/year

- Local CPA (USA): $80,000–$120,000/year

- Offshore CPA: $18,000–$50,000/year

So, if you’re calculating how much does it cost to hire a CPA, offshore is often 50%+ more cost-effective.

Q5: Is it safe to hire an offshore CPA firm?

Yes, if you choose providers with strong data security (GDPR, SOC 2) and financial compliance experience. Reputable firms handle everything from payroll to audit support under secure systems.

Q6: Can offshore CPAs handle UK/US tax laws?

Absolutely. Many hired offshore CPAs are trained in UK FRS, US GAAP, and global tax frameworks. They often come certified with ACCA, CPA (USA), or CA (India) qualifications.

99% SLA Delivery

99% SLA Delivery 10,000+ Pin codes Network in India

10,000+ Pin codes Network in India