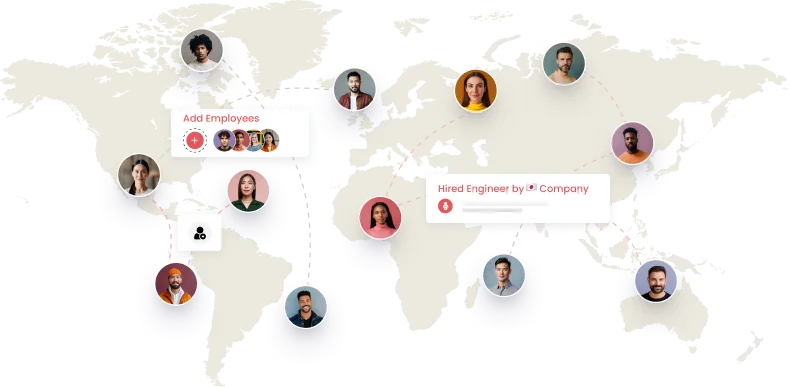

Trusted by Companies Based All over The World

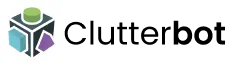

Achieve Error-Free Payroll with our Outsourcing Solutions

Call or email us for a free quote.

Accounting Ally offers businesses around the world a single platform to compliantly hire employees and contractors in 20+ countries, manage payroll and international payments in 15 currencies, and keep track of their global workforce costs.

Our US payroll outsourcing services are designed to manage the complexities of US payroll, ensuring compliance with federal and state regulations. We handle:

State-Specific Forms: Manage state-specific tax forms and requirements based on the location of your business.

Benefits Administration: Handle employee benefits such as health insurance, retirement plans, and other deductions.

Comprehensive Reporting: Access detailed payroll reports, tax filings, and compliance documentation.

Employee Access Portal: Provide a self-service portal for employees to view pay stubs, tax forms, and manage personal payroll information.

Expert Support Team: Dedicated support for payroll inquiries and compliance assistance.

Our UK payroll outsourcing services ensure that your payroll processes are efficient, accurate, and compliant with local regulations. We manage all aspects of UK payroll, including:

Pension Management: Administer automatic enrolment and contributions to pension schemes.

Real-Time Reporting: Generate detailed payroll reports and compliance analytics

Employee Self-Service Portal: Allow employees to access payslips, tax documents, and update personal details.

Dedicated Support Team: Expert guidance and support for resolving payroll-related issues and queries.

Our payroll outsourcing services for Canada are designed to ensure efficient, accurate, and compliant payroll management. We handle all aspects of Canadian payroll, including:

Our payroll outsourcing services for India ensure efficient management of your payroll while adhering to local regulations. We handle all aspects of Indian payroll, including:

Our payroll outsourcing services for New Zealand are designed to streamline your payroll operations while ensuring compliance with local regulations. We handle all aspects of New Zealand payroll, including:

Benefits Administration: Handle employee benefits such as health insurance and additional KiwiSaver contributions.

Real-Time Reporting: Access detailed payroll reports and compliance documentation to track and manage payroll effectively.

Employee Self-Service Portal: Provide a portal for employees to view payslips, tax documents, and manage their personal payroll information.

Dedicated Support Team: Expert support for addressing payroll-related queries and ensuring compliance with New Zealand regulations.

Discover your solution

Dedicated resources to work exclusively on your Payroll.

Fixed Monthly Fee

Suitable for Mid and Large Size Businesses.

Pay only for the No of Payslips Processed.

Per Payslip Price based on the Complexities & Volume.

Ideal for Early or Growth Stage Businesses

Experience the ease of professional payroll

management tailored to your needs.

Talk to our team about your specific bookkeeping needs. They will provide a personalized quote on your first call.

Based on your unique business situation, you’ll get access to an Payroll Expert who best meets your needs.

Get back to business! Need to reach your accountant? Connect over the phone, video, or in person.

Contact Us

Reach out to us today to start a conversation about your

accounting needs. Get One-on-One expert support

Just drop in your details here and we'll connect with you soon!

Our Service Models offers the necessary resources you need to succeed, whether

you require short-term support or a scalable solution for long-term growth.

Global payroll outsourcing means hiring a provider to manage payroll across multiple countries. It benefits your business by ensuring compliance, reducing costs, and freeing up internal resources.

Payroll Outsourcing works in a simple steps like :

We ensure compliance by staying updated with local laws and using technology to automate regulatory checks, minimizing risks and ensuring accuracy.