Why CPA Firms Should Consider Accounts Outsourcing to India

Introduction

In today’s competitive business landscape, CPA firms are constantly seeking ways to streamline operations, reduce costs, and enhance efficiency. One strategic approach that has gained significant traction is outsourcing finance and accounting (F&A) functions to India. This article explores the compelling reasons why CPA firms should consider this outsourcing strategy to unlock numerous benefits and drive sustainable growth.

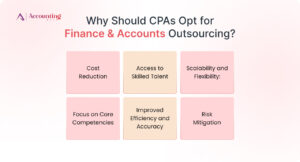

Why Should CPAs Opt for Finance & Accounts Outsourcing?

- Cost Reduction: India offers a significant cost advantage for F&A outsourcing. With lower labor costs and operational expenses, CPA firms can significantly reduce their overall financial burden.

- Access to Skilled Talent: India boasts a vast pool of skilled finance and accounting professionals with expertise in various accounting standards, including US GAAP and IFRS. Outsourcing to India ensures access to qualified talent who can handle complex accounting tasks effectively.

- Scalability and Flexibility: Outsourcing allows CPA firms to scale their F&A operations up or down as needed, accommodating fluctuations in workload without the overhead of hiring and training additional in-house staff.

- Focus on Core Competencies: By outsourcing F&A functions, CPA firms can concentrate on their core competencies, such as providing strategic financial advice, tax planning, and audit services. This focused approach can enhance value for clients and improve overall business performance.

- Improved Efficiency and Accuracy: Outsourcing to India can lead to improved efficiency and accuracy in F&A processes. Specialized outsourcing providers often have advanced technology and streamlined workflows that can optimize operations and minimize errors.

- Risk Mitigation: Outsourcing can help mitigate risks associated with data security and compliance. Reputable outsourcing providers implement robust security measures and adhere to industry best practices to protect sensitive financial information.

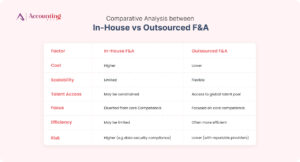

Comparative Analysis Between In-House Vs Outsourced F&A

| Factor | In-House F&A | Outsourced F&A |

| Cost | Higher | Lower |

| Scalability | Limited | Flexible |

| Talent Access | May be constrained | Access to global talent pool |

| Focus | Diverted from core competencies | Focused on core competencies |

| Efficiency | May be limited | Often more efficient |

| Risk | Higher (e.g., data security, compliance) | Lower (with reputable providers) |

FAQs

How do we choose the right outsourcing partner for finance and accounting needs?

When selecting an outsourcing partner, assess their industry experience, technical skills, and service offerings. Ensure they understand your business needs and review their track record and client feedback. Look for flexibility in scaling services and focus on clear communication and collaboration to align with your goals.

Whether hiring an in-house accountant is cheaper or Outsourced Accountant?

Hiring an in-house accounting team involves multiple costs, such as salaries, benefits, and the risk of mistakes. The U.S. Bureau of Labor Statistics reports the median accountant salary is $47,440 with benefits adding up to a total cost of $60,000 approx. per year. Additional expenses include training new hires, recruiting, and dealing with turnover, which can cost up to 40-50% of the employee’s annual salary. As the Practice grows, these costs and inefficiencies increase, making in-house accounting more expensive.

On the other hand, outsourcing accounting is generally cheaper and more efficient. Hiring and training staff incurs significant expenses and risks of turnover. Outsourced teams offer more experience and reduce mistakes.

For example, In house staff member could cost around $60,000, while outsourcing might cost $24,000 to $30,000 annually, saving $30,000 to $36,000. These savings can be substantial as you grow your accounting team. Outsourced accounting can scale with your Practice, ensuring continued growth without added manual processes.

Conclusion

Outsourcing finance and accounting functions to India presents a compelling opportunity for CPA firms to achieve significant benefits, including cost reduction, access to skilled talent, improved efficiency, and enhanced focus on core competencies. By carefully evaluating their specific needs and selecting a reputable outsourcing partner, CPA firms can leverage the advantages of outsourcing to drive business growth and success.